Institutional Interest Rises as Dogecoin Drops Below $0.13 Mark

# Institutional Interest Grows as Dogecoin Falls Below $0.13

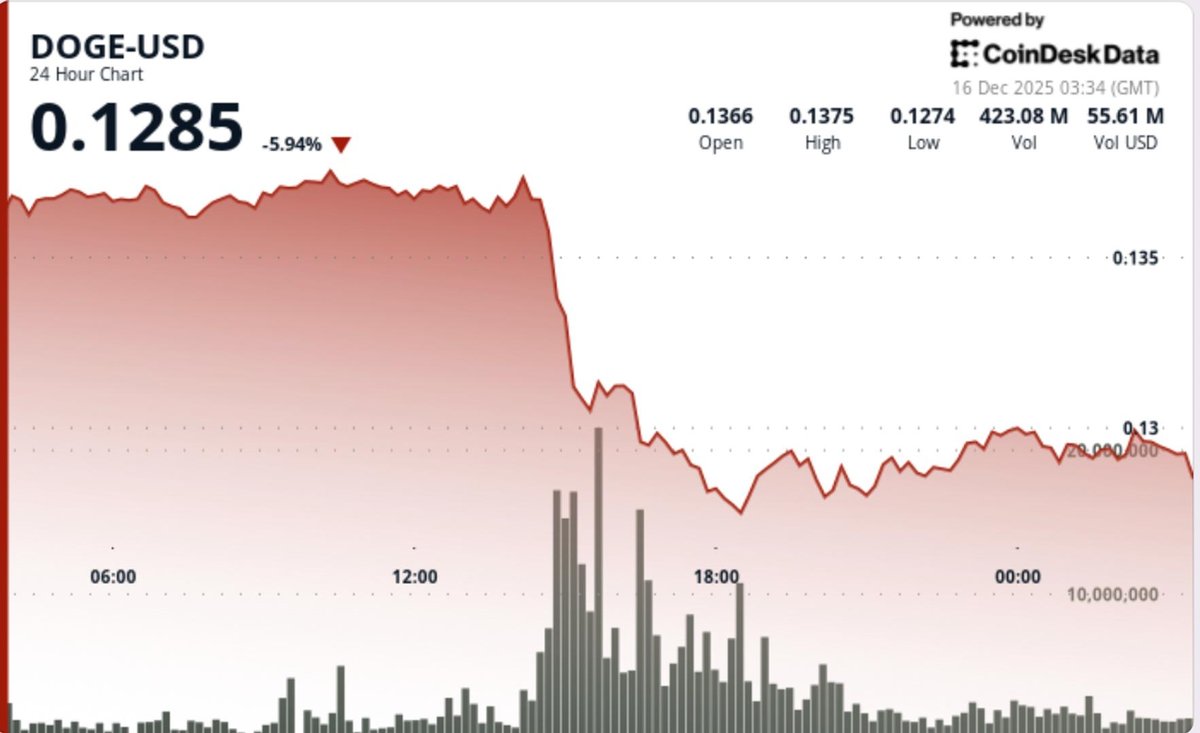

The recent decline of Dogecoin below the $0.13 mark has sparked significant interest among institutional investors. This price drop has led to a reevaluation of the cryptocurrency's potential within investment portfolios, particularly as it shifts further from the speculative nature that has characterized much of its trading history.

As Dogecoin's value plummeted below the $0.13 threshold, analysts noted that this could be an advantageous entry point for institutional buyers. Many financial experts believe that such sharp declines often attract larger investors who view them as opportunities to acquire assets at a discount. With increased scrutiny and analytics available to these institutions, many are now examining the long-term viability and stability of cryptocurrencies like Dogecoin.

Several market analysts have pointed out that institutional participation could very well be a game-changer for Dogecoin. They argue that as these larger entities enter the market, there is the potential for more structured trading and increased volatility management. This change may lead to improved liquidity, making Dogecoin more appealing to both institutional and retail investors alike.

“Historically, dips in the market have attracted institutional attention due to the potential for higher returns,” commented a leading cryptocurrency analyst. The presence of traditional financial entities could lend additional credibility to Dogecoin, thereby stabilizing its price movements over time.

Despite current fluctuations, the interest from institutional players suggests that Dogecoin may still play a relevant role in diversified investment strategies. As this situation develops, the cryptocurrency's resilience to market changes will continue to be tested, making it a focal point of discussion in financial institutions and among investors looking for innovative asset opportunities.

This report is for informational purposes only and is not financial advice.