The UK's Economy in 2025: Challenges and Opportunities Ahead

As the year draws to a close on December 15, 2025, the United Kingdom's economy presents a mixed picture of resilience amid headwinds.

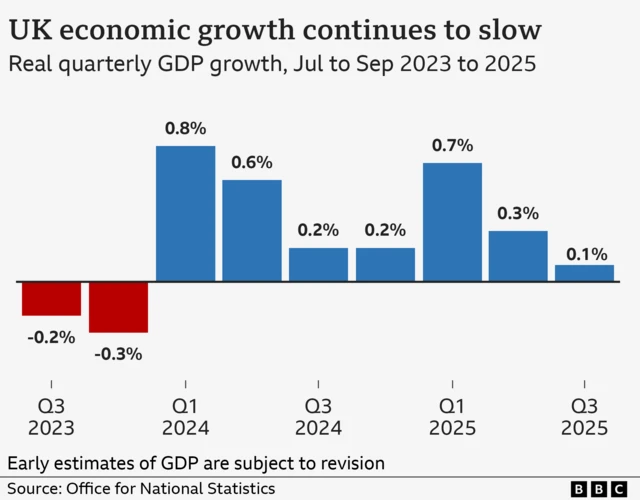

Gross domestic product (GDP) growth for 2025 is forecasted at 1.5% by the Office for Budget Responsibility (OBR), a modest uptick from earlier projections, driven by stronger-than-expected performance in the first quarter but tempered by recent contractions.However, the latest monthly data reveals fragility: GDP shrank by 0.1% in October, marking the first three-month decline since December 2023, influenced by disruptions in manufacturing and subdued consumer confidence.Compounding this, public sector borrowing hit £17.4 billion in October alone—the third-highest October figure since records began—pushing the financial year-to-date total to £116.8 billion, the second-highest on record outside the COVID era.These figures underscore a fiscal strain exacerbated by elevated debt servicing costs, with interest payments already reaching £92 billion this financial year.Yet, glimmers of opportunity shine through in green energy investments and easing inflation pressures.

This article delves into the key challenges—borrowing pressures, post-Brexit trade frictions, and inflationary trends—while highlighting pathways forward via sustainable investments, offering a balanced view for policymakers, businesses, and households navigating 2025's economic landscape.The Borrowing Burden: £17.4 Billion in October and Fiscal Tightropes AheadGovernment borrowing remains a persistent drag on the UK's fiscal health, reflecting structural deficits and the lingering costs of post-pandemic recovery.

In October 2025, public sector net borrowing (PSNB) reached £17.4 billion, £1.8 billion lower than the prior year but still alarmingly high, contributing to a seven-month cumulative deficit of £116.8 billion—8.4% above the same period in 2024 and £9.9 billion over the OBR's March forecast.This surge is not isolated; borrowing has hovered around 5% of GDP for five consecutive years, the longest such streak since the 1990s, fueled by elevated spending on welfare, health, and debt interest amid stagnant revenues.The implications are profound.

The UK's debt-to-GDP ratio stands at 101%, lower than the US (122%) or Japan (237%) but still burdensome, with borrowing costs commanding a "premium" of 0.4 to 0.8 percentage points above international peers since Labour's 2024 election victory—translating to an extra £7 billion annually for taxpayers.Chancellor Rachel Reeves' Autumn Budget in November aimed to address this through tax hikes and spending restraint, projecting PSNB to fall from 4.5% of GDP in 2025-26 to 1.9% by 2030-31, the sharpest reduction among G7 nations.Measures include freezing fuel duties until September 2026 (costing £2.4 billion) and introducing a Regulated Asset Base levy for nuclear projects like Sizewell C, expected to yield £1.4 billion by 2030-31.Key Borrowing Metrics (2025) Value Change from 2024 October PSNB £17.4bn -9.6% FY to October Total £116.8bn +8.4% Debt-to-GDP Ratio 101% Stable Annual Interest Payments £92bn Rising

This table illustrates the scale: while short-term relief from bond market confidence—bolstered by doubled fiscal headroom to £22 billion by 2030—may ease the premium, risks abound.Uncertainties in welfare pressures, local authority budgets, and complex tax reforms could widen deficits, potentially eroding the £21.7 billion margin against fiscal rules.For businesses, higher corporate taxes (up 1.1% of GDP by 2029-30) signal caution on investment, while households face squeezed disposable incomes, curbing consumption—a key GDP driver.Yet, this consolidation could stabilize markets, fostering lower long-term yields and supporting a soft landing if global conditions align.Navigating Post-Brexit Trade Waters: Lingering Barriers and Lost PotentialNine years post-referendum, Brexit's trade scars continue to impede UK growth, with non-tariff barriers erecting invisible walls around the Single Market.

By early 2025, the economy is estimated to be 6-8% smaller than a no-Brexit counterfactual, per macro and firm-level data, with investment 12-18% lower, employment 3-4% down, and productivity similarly depressed.Goods exports to the EU remain 18% below 2019 levels in real terms, despite the Trade and Cooperation Agreement (TCA) averting tariffs, as customs checks, regulatory divergences, and supply chain disruptions persist.The impact cascades through sectors: EU-UK exports contracted nearly 40% post-transition, with no significant redirection to third countries, hitting manufacturing hardest—exemplified by a 17.7% plunge in vehicle output in Q3 2025 due to Jaguar Land Rover's cyber disruptions amid border frictions.Services, once a Brexit bright spot, face 4-5% export shortfalls, with 16% declines in barrier-hit EU markets like finance and consulting.Foreign direct investment (FDI) flows dipped 4%, though temporary relocations softened the blow.Opportunities lie in diversification: New deals, like the May 2025 India FTA reducing tariffs on autos and steel, and a US pact easing 10% duties, could add £2-3 billion annually if fully realized.The North Sea Future Plan emphasizes clean exports in wind, CCUS, and hydrogen, potentially offsetting oil/gas declines.Yet, experts warn these gains won't fully repair the 4% long-run productivity hit; rejoining elements of the Single Market remains politically untenable under Labour's "red lines."For exporters, streamlining VAT and customs via digital tools could reclaim 1-2% GDP growth, but persistent uncertainty deters investment—UK FDI lags G7 peers by 10-15%.Inflation on the Wane?

Trends and Trajectories in 2025After peaking at 3.8% in September, CPI inflation eased to 3.6% in October 2025—the lowest in four months—aligning with Bank of England expectations but still double the 2% target.Core inflation dipped to 3.4%, a six-month low, driven by softer housing/utilities (5.2% vs. 7.3%) and services (4.5% vs. 4.7%), though food prices accelerated to 4.9%, the fastest since January 2024.This uptick from 2024's 2.5% average stems from administered price hikes—water bills and Vehicle Excise Duty—and food cost surges tied to domestic factors like poor harvests.Energy caps moderated gas/electricity rises (2.1% and 2.7%), but global volatility lingers.The OBR anticipates a temporary 3.2% average for 2025, peaking monthly at 3.8% in July, before falling to 2.1% in 2026 as energy comparisons normalize and spare capacity builds.For households, this means real wage erosion—cumulative growth outpaces March forecasts by 0.75% over two years—squeezing spending, which comprises 60% of GDP.Businesses face margin pressures, with 72% of investors noting volatility as a barrier to energy transition bets.Positively, the Bank's November hold at 4.25% (with cuts eyed for December) signals easing, potentially dropping to 3.5% by early 2026, boosting confidence.Treasury surveys peg Q4 2025 at 3.5%, falling to 2.3% in Q4 2026, supporting a virtuous cycle if wage-price spirals abate.Green Shoots: Investments Powering a Sustainable ShiftAmid fiscal clouds, green energy emerges as a beacon, with over £50 billion in private announcements since July 2024, doubling the clean energy workforce to 800,000 by decade's end.The Clean Power 2030 Plan targets 50GW offshore wind, 30GW onshore, and 47GW solar by 2030, backed by £8.3 billion for Great British Energy and £1.555 billion for Contracts for Difference auctions.Q2 2025 approvals surged: 6,803MW offshore wind (+53% YoY), 4,831MW solar (+32%), though onshore wind dipped 29% to 915MW due to planning bottlenecks.Ofgem's nod to early investments in Eastern Green Links (4GW subsea cables) and Grimsby-Walpole lines promises £3-6 billion consumer savings via faster renewables integration.The £22 billion CCUS pledge and North Sea strategy for hydrogen/CCUS could create 16,000 jobs at sites like Forth Green Freeport.Investors are bullish: 56% poured into renewables, 54% into storage, with BII committing £308 million in Southeast Asia for 1.8GW clean capacity.The Clean Energy Industries Plan eyes £30 billion annual investments by 2035, leveraging £700 million supply-chain funding.Challenges include grid upgrades and regulatory clarity, but these could add 0.5-1% to GDP via jobs and exports, offsetting Brexit drags.Peering into 2026: Steady Growth Amid Cautious OptimismLooking to 2026, experts converge on 1.2-1.5% GDP growth, a slowdown from 2025's 1.4-1.5% but resilient versus G7 peers.Inflation should ease to 2.5%, with Bank Rate at 3.5%, aiding consumption via fiscal loosening early-year before tax drags bite.OBR sees steady 1.5% potential output, though productivity risks loom.Upside from AI, trade deals, and £30 billion green inflows could push higher growth, but downside from fiscal contraction or geopolitics persists.Deutsche Bank flags domestic headwinds like hiring weakness, yet supportive policy.Overall, 2026 hinges on execution: balancing austerity with investment to harness green tailwinds and mend trade fractures for sustained prosperity.