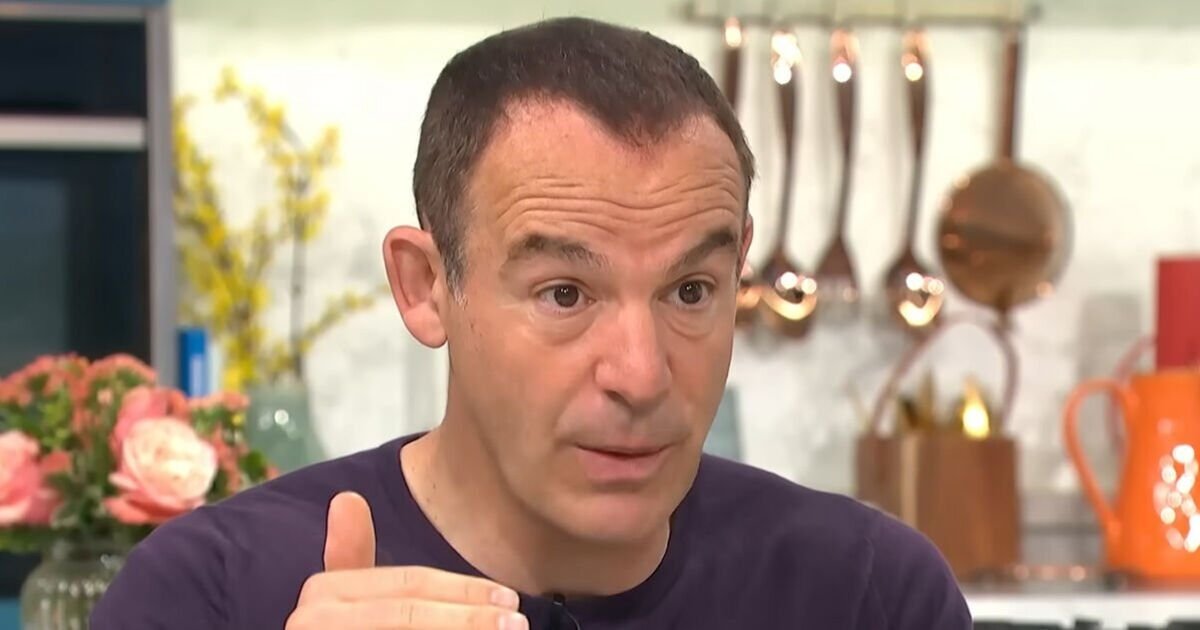

Martin Lewis Warns HMRC Rule Causes Unnecessary Tax Payments for Savers

# Martin Lewis Reveals HMRC Rule Leads to Excessive Tax Payments for Many

Money-saving expert Martin Lewis has highlighted a crucial rule set by HMRC, which causes "many people" to pay unnecessary amounts in taxes. This situation arises in connection with interest earnings on savings accounts, where individuals may not realize that their interest is not immediately taxable when received.

Lewis explained that many savers may be paying tax on their interest earnings without understanding the actual rules governing these payments. It’s important for individuals to recognize that any interest earned may not require immediate taxation upon receipt.

By informing the public about this HMRC regulation, Lewis aims to ensure that people can take advantage of potential savings. Many individuals can avoid overpaying by simply being aware that the timing of interest payments can affect their tax obligations.

Taxpayers should therefore reassess their situation to confirm whether they are unnecessarily contributing more to HMRC. Knowledge of the correct tax implications during the receipt of interest can lead to significant savings for numerous households across the country.