Bitcoin Hashrate Declines 15% Since October Peak Amid Miner Challenges

**Bitcoin Hashrate Falls 15% from October Peak as Miner Struggles Continue**

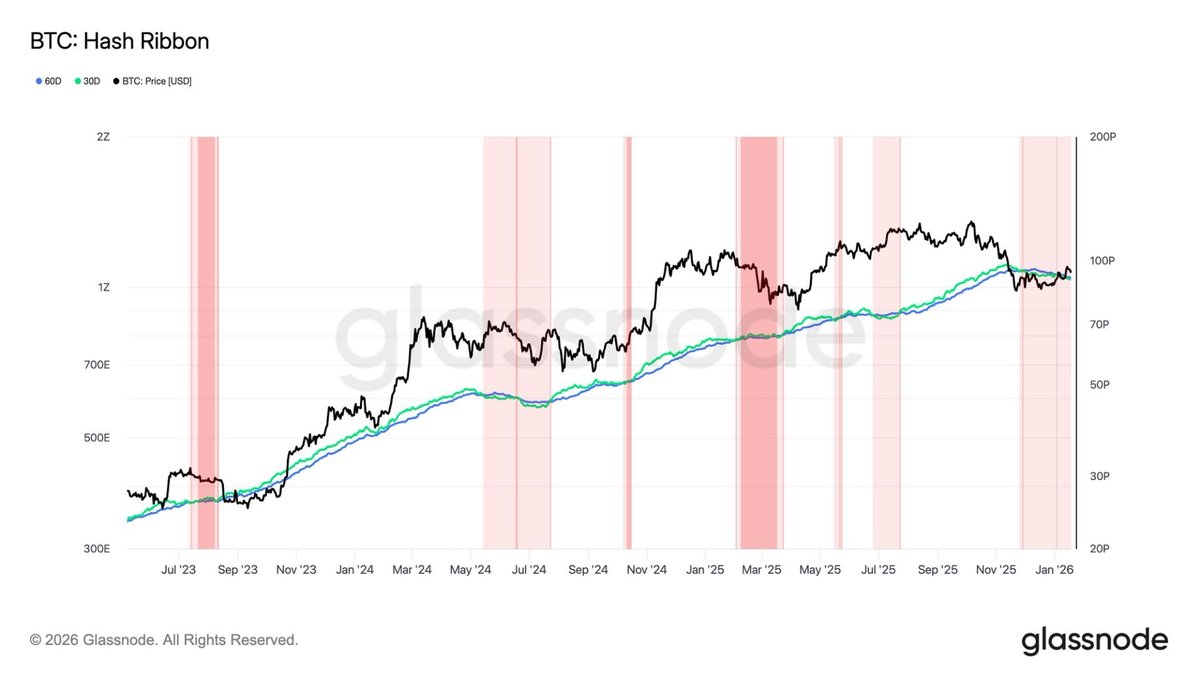

The hashrate of Bitcoin has decreased by 15% since reaching its peak in October, a significant decline attributed to ongoing miner capitulation that has persisted for nearly 60 days. This downturn reflects the increasing difficulties that Bitcoin miners are facing in a challenging economic environment.

Recent trends reveal that the hashrate plummeted from approximately 290 EH/s in October to about 246 EH/s. This shift comes amid a backdrop of fluctuating market conditions and rising operational costs for miners.

The factors driving this capitulation include lower Bitcoin prices and intensified competition among miners. Many have been forced to shut down operations or sell off equipment to cover expenses, leading to an overall contraction in the network’s processing power.

Historically, similar drop-offs have occurred when miner profitability wanes, underscoring the fragility of the cryptocurrency mining sector. If these conditions continue, further sell-offs and operational shut-downs may be expected.

As the industry navigates this volatile atmosphere, analysts will be closely monitoring how these trends affect Bitcoin's overall market stability and future price movements.

This report is for informational purposes only and is not financial advice.